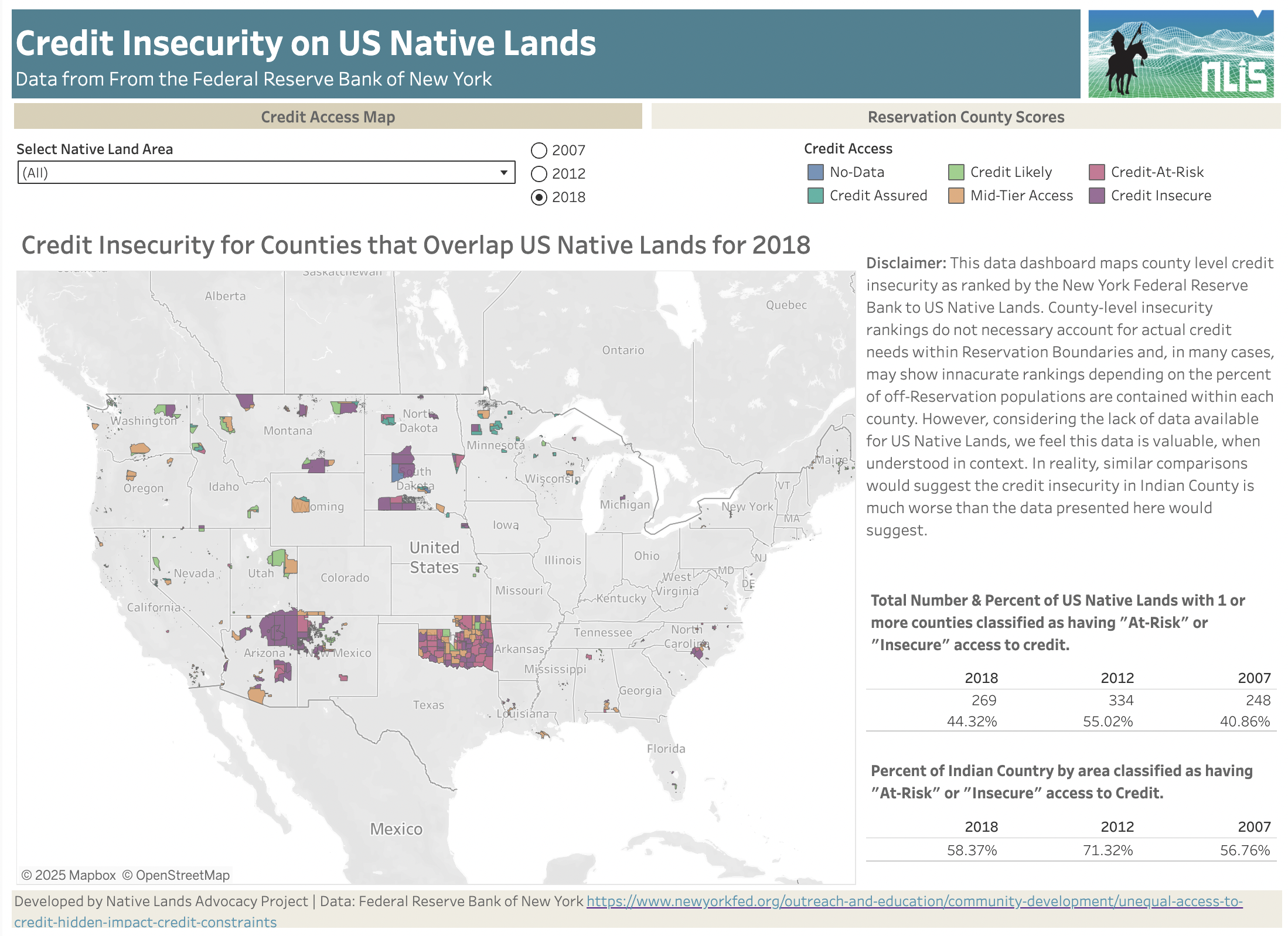

The new Credit Insecurity dashboard by the Native Lands Advocacy Project (NLAP) provides an at-a-glance understanding of tribal access to credit, revealing key discrepancies on Native lands when compared to national figures.

About the Data

The Native Lands Advocacy Project’s (NLAP’s) new Credit Insecurity on US Native Lands dashboard maps county-level credit insecurity data (as ranked by the New York Federal Reserve Bank) to U.S. Native Lands. There are inherent limitations to mapping county-level data to reservation boundaries, and in the case of this data, the rankings may be inaccurate based on the percentage of off-reservation population contained within each county. However, considering the lack of data available for U.S. Native Lands, we still feel that this data is valuable when considered in context—and in fact, other research would suggest that the credit insecurity in Indian Country is worse than the data presented here.

The credit insecurity data produced by the Federal Reserve Bank of New York centers on the Credit Insecurity Index, a multidimensional geographic measure of access to affordable credit across the U.S.

The index is constructed using several factors:

The share of adults without a credit score or file (“credit invisible”).

The percentage of the population that has limited or no access to mainstream, affordable credit products.

The proportion of people relying on high-cost debt (such as payday loans or similar subprime products) and those struggling to make debt payments.

Credit utilization rates (use of more than 30% of available credit).

The share of residents with subprime credit scores and consistently delinquent payment histories.

Credit Insecurity on U.S. Native Lands

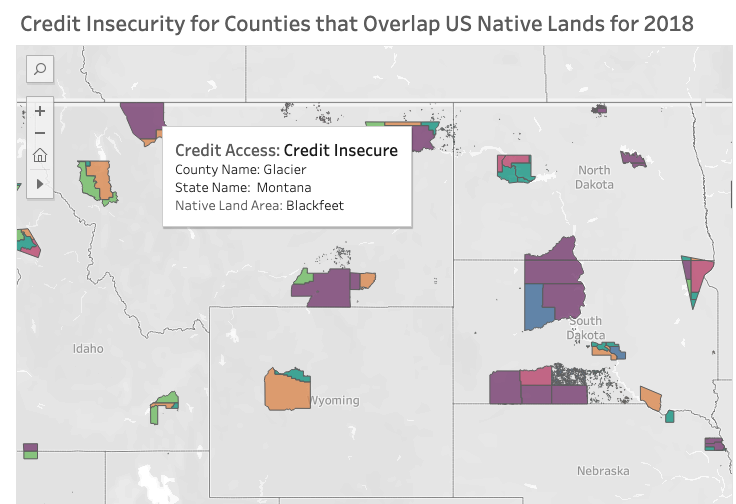

The image on the left shows the Credit Insecurity Index mapped to reservations in Montana, Wyoming, and the Dakotas. In the dashboard, hovering over a land area will generate a tooltip showing the name of the County, State, and Native Land Area. In this screenshot, Glacier County is highlighted as a credit insecure area. Glacier County is about 71% comprised of the Blackfeet Reservation (another 21% of the county is part of Glacier National Park, which means that less than 10% of the county is populated off-reservation land).

Many Native land areas in the screenshot are shown to be Credit-At-Risk or Credit Insecure—and this is not unique to this particular region. In NLAP’s calculations, we found that between 2007 and 2018, approximately 62% of people living on reservations had very low access to credit (“at-risk” and “insecure”) compared to 26% of the average national population.

These numbers are stark evidence of the reality lived by tribal residents in the United States and the difficulties they face in accessing credit, which is crucial for growth in many ways.

NLAP plans to add 2023 data to this dashboard as soon as possible. However, we do know that while overall credit security has nationally improved from 2018 to 2023, two-thirds of the counties classified as credit insecure in 2018 stayed in that tier in 2023 (“New York Fed,” 2025). This is likely to be the case for Native land areas, especially those in rural areas.

(If you’d like to be notified of NLAP’s future analysis of the 2023 credit insecurity data, consider joining our mailing list at the bottom of this page.)

Key Issues for Access to Credit in Indian Country

Why is credit insecurity higher on Native lands than the national average? Key factors include:

Prevalence of being unbanked: Many Native communities have higher rates of individuals without bank accounts or formal credit histories. This is compounded by the absence or scarcity of mainstream financial institutions on or near reservations, making it far more difficult for Native entrepreneurs and families to access conventional lending or financial services (Kell, 2025).

Low credit scores and insufficient collateral: Native businesses and residents frequently have limited or poor credit due to lower income, lack of credit-building opportunities, or historical financial exclusion (LaPlante & Wheeler, 2024). Traditional lenders often require good credit and substantial collateral, which many Native borrowers cannot provide.

Geographic and technological constraints: Remote locations and limited broadband access make it harder for many in Indian Country to connect with financial institutions, apply for credit, or benefit from digital banking services (Kell, 2025).

Inadequate access to technical assistance: Few institutions offer financial education, credit-building support, and technical help tailored to Native communities. Those that exist—like Native CDFIs—play a critical role by understanding local challenges and providing more accessible, flexible financial support (Kell, 2025).

Systemic bias and responsibility norms: Mainstream banks, guided by fiduciary responsibility, tend to avoid higher-risk loans and focus on financially stable clients, shutting out those striving to improve their situation in Native communities.

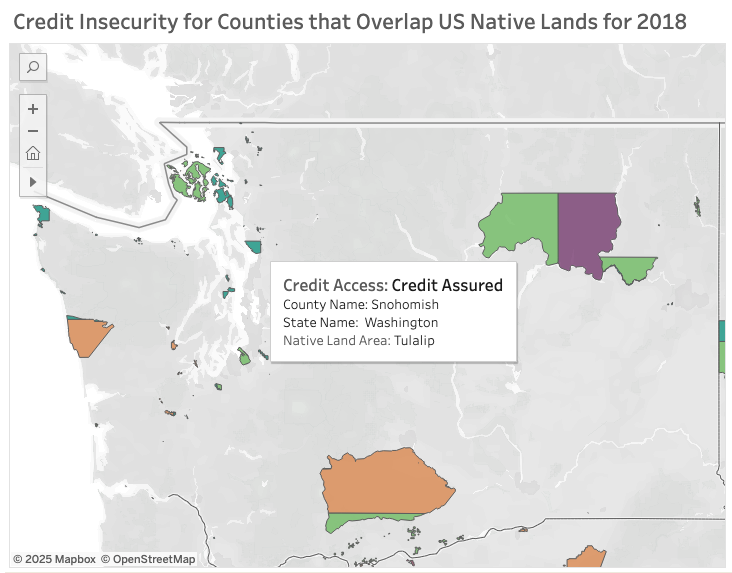

A preliminary exploration of the Credit Insecurity on U.S. Native Lands dashboard confirms the influence of these variables. For example, this screenshot displays reservations in Washington State. Many of Washington’s reservations (especially those near the Puget Sound, such as the highlighted Tulalip reservation) are located in less rural areas and are more likely to have access to key factors such as mainstream financial institutions and broadband. Note that many of these reservations are classified as Credit Assured or Credit Likely.

However, most reservations in the U.S. are located in rural areas, a majority (54%) of American Indian/Alaska Native people live in rural and small-town areas, and 68% live on or near their tribal homelands (Dewees & Marks, 2017). Even for those located in less rural areas, factors like historical exclusion and culturally irrelevant financial support may hinder individuals from accessing credit. Ensuring that these individuals have equitable access to credit is vital for advancing the economic self-determination, financial inclusion, and community resilience of tribes.

Strengthening Credit Security in Indian Country

Improving access to credit in Indian Country is both a challenge and a necessity. Data like this can be used for:

Evidence-based policy and targeted interventions: Accurate data on credit insecurity allows tribal leaders to understand the scope and nature of the problem—where credit access is worst, which groups are most affected, and what types of financial products are needed. This supports more effective planning and resource allocation.

Community advocacy: Reliable data provides tribes with the necessary evidence to advocate for targeted federal, state, and philanthropic support, funding, and legislative changes tailored to their unique financial realities.

Program development and impact measurement: Tribes, Native CDFIs, and other stakeholders can use this data to design programs that address credit access challenges and measure the success of their initiatives over time.

Highlighting social determinants of economic health: Credit insecurity data reveals links between financial exclusion and broader social outcomes such as health disparities, persistent poverty, and reduced economic opportunities, helping tribes address root causes holistically.

Key actors helping to strengthen tribal credit access and financial security are Native Community Development Financial Institutions, or CDFIs. These financial institutions are dedicated to meeting the unique financial needs of Native communities.

"They may be banks, credit unions, loan funds, or venture funds. These institutions go beyond traditional lending, offering culturally grounded financial services and technical assistance. Over the past three decades, Native CDFIs have emerged as vital players in Indian Country, where factors such as limited banking infrastructure, geographic isolation, and the legacy of historical economic disadvantages continue to hinder access to credit. Native CDFIs work toward filling the access gaps by fostering trust through culturally compatible practices."

Harley Kell, 2025

For example, the Native American Development Corporation (NADC) has worked with Native communities in Montana, Wyoming, and the Dakotas (one of the regions highlighted in an above screenshot) for almost three decades, offering tailored support ranging from business and economic development to holistic health and community programs. CDFIs like NADC are able to consider the unique capacities and needs of the individuals they serve, reducing issues found in mainstream financial institutions such as inflexible collateral requirements and culturally irrelevant education.

Another Native CDFI offering vital services to Indian Country is Akiptan, whose mission is to “transform Native agriculture and food economies by delivering creative capital, leading paradigm changes, and enhancing producer prosperity across Indian Country” (Innovative Financing, n.d.). Akiptan not only offers a suite of loans to Native agriculture producers, but works directly with producers to provide personalized feedback, technical assistance, and financial literacy training. Akiptan’s services are especially critical considering the history of discriminatory lending practices faced by Native agriculture producers.

These are just two of the dozens of CDFIs combating credit insecurity on Native lands. For a full list of certified Native CDFIs (as of 2024), see the appendix titled “All Certified Native CDFIs” at the end of this post.

However, despite offering vital financial services to rural Americans, CDFIs have recently been threatened—first by a March Executive Order calling for the Treasury’s CDFI Fund to be “eliminated to the maximum extent consistent with applicable law” (Exec. Order No. 14238, 2025) and most recently by the permanent Reduction In Force of all staff at the CDFI Fund (Government Shutdown, 2025). Organizations including the Native CDFI Network (NCN) have spoken out against these policies, emphasizing that decades of economic progress would be undone by the dismantling of the CDFI Fund (Native CDFI Network Responds, 2025).

As networks like NCN advocate for tribal interests at the national level, organizations like NLAP and our ecosystem of relations continue to support grassroots work in Indian Country. NLAP remains committed to upholding tribal sovereignty, increasing tribal access to important data, and partnering with tribes and tribal organizations to increase grassroots resilience. If you have questions about this credit insecurity data, suggestions for useful future data tools, or if you’d like to partner with NLAP, contact us below!

Authors

Written by Aude Chesnais and Emma Scheerer

All Certified Native CDFIs

- Affiliated Tribes of Northwest Indians Financial Services

- Akiptan, Inc.

- Alaska Growth Capital BIDCO, Inc.

- Black Hills Community Loan Fund, Inc.

- Chi Ishobak, Inc.

- Chickasaw Banc Holding Company

- Chickasaw Community Bank

- Choctaw Federal Credit Union

- Choctaw Home Finance Corporation

- Citizen Potawatomi Community Development Corporation

- Community Development Financial Institution of the Tohono O’odham Nation

- Cook Inlet Lending Center, Inc.

- Council for Native Hawaiian Advancement

- First American Capital Corporation, Inc.

- First Nations Community Financial

- FIVE RIVERS LOAN FUND, INC

- Four Bands Community Fund, Inc.

- Four Directions Development Corporation

- Haa Yakaawu Financial Corporation

- Hawaii Central Federal Credit Union

- Hawaii Community Lending Inc

- HAWAII FIRST FCU

- Ho-Chunk Community Capital Inc.

- Hopi Credit Association

- Indian Land Capital Company LLC

- Kauai Government Employees Federal Credit Union

- Lake Superior Community Development Corp.

- Lakota Federal Credit Union

- Lakota Fund, Inc., The

- Lei Hoolaha

- Local Bank

- Lower Brule Community Development Enterprise, LLC

- Mazaska Owecaso Otipi Financial, Inc

- Mni Sota Fund

- Molokai Community Federal Credit Union

- Montana Homeownership Network, Inc. The

- Mvskoke Loan Fund

- NACDC Financial Services Inc.

- Native American Bancorporation, Co.

- Native American Bank, N.A.

- Native American Development Corporation

- Native Community Capital

- Native Partnership for Housing, Inc.

- Native360 Loan Fund, Inc.

- Navajo community Development Financial Institution Inc Non Profit

- Nimiipuu Community Development Fund

- Northern Shores Community Development, Inc.

- Northwest Native Development Fund

- Oweesta Corporation

- Pacific Northwest Tribal Lending, a Community Development Financial Institution

- Peoples Partners for Community Development

- Salt River Financial Services Institution

- San Carlos Apache Tribe Relending Enterprise

- Seneca Nation of Indians Economic Development Company

- Sequoyah Fund Inc., The

- Sisseton Wahpeton Federal Credit Union

- Spruce Root, Inc.

- Taala Fund

- The Cherokee Nation d/b/a Cherokee Nation Economic Development Trust Authority, Inc

- Tigua Community Development Corporation

- Tiwa Lending Services

- White Earth Investment Initiative

- Wind River Development Fund

- Wisconsin Native Loan Fund, Inc.

- Woodland Financial Partners Inc

- Yurok Alliance for Northern California Housing

Works Cited

CICD Releases Entrepreneurs Credit-Access Challenges Study. (2024, February 26). Native CDFI Network. https://nativecdfi.net/blog/2024/02/26/cicd-releases-new-study-on-native-entrepreneurs-credit-access-challenges/

Exec. Order No. 14238, 3 C.F.R. 13043 (2025). https://www.federalregister.gov/documents/2025/03/20/2025-04868/continuing-the-reduction-of-the-federal-bureaucracy

Government shutdown reductions in force impact CDFI Fund. (2025, October 14). America’s Credit Unions. https://www.americascreditunions.org/news-media/news/government-shutdown-reductions-force-impact-cdfi-fund

Kell, H. (2025, May 28). Using tailored services, Native CDFIs work to foster financial resilience. Federal Reserve Bank of Minneapolis. https://www.minneapolisfed.org/article/2025/using-tailored-services-native-cdfis-work-to-foster-financial-resilience

LaPlante, A., & Wheeler, L. (2024, February 21). Native entrepreneurs face credit-access challenges. Federal Reserve Bank of Minneapolis. https://www.minneapolisfed.org/article/2024/native-entrepreneurs-face-credit-access-challenges

Native CDFI Network Responds to Administration’s Decision to Eliminate CDFI Fund and Terminate Staff. (2025, October 13). Native News Online. https://nativenewsonline.net/currents/native-cdfi-network-responds-to-administration-s-decision-to-eliminate-cdfi-fund-and-terminate-staff

What is a Native CDFI? (n.d.). Native CDFI Network. Retrieved October 20, 2025, from https://nativecdfi.net/about/what-is-a-native-cdfi/

Why Native CDFIs Matter. (n.d.). Native CDFI Network. Retrieved October 20, 2025, from https://nativecdfi.net/testimonials-for-native-cdfis/